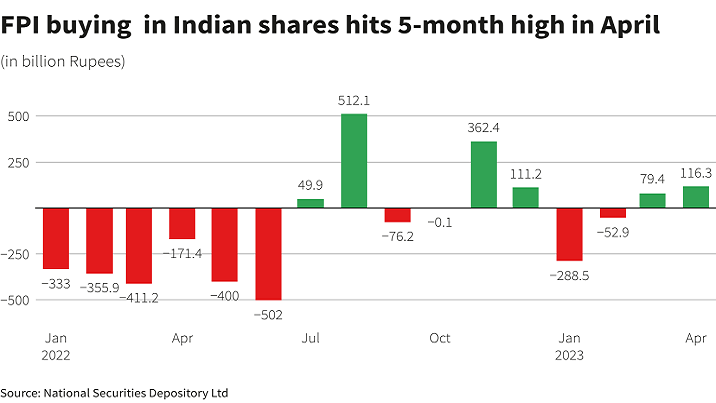

Foreign portfolio investors (FPIs) were net buyers of Indian equities in April, the first month of the new financial year, National Securities Depository Ltd (NSDL) data showed on Friday.

FPIs purchased shares worth 116.31 billion Indian rupees ($1.42 billion) on a net basis in April, the highest since November 2022. They had been net purchasers in the previous month too, though largely due to U.S. investment firm GQG Partners' $1.87 billion investment in four Adani Group companies in early March.

"Stronger-than-expected corporate earnings, stable macroeconomic indicators like Purchasing Managers' Index and GST collection figures have led to return of FPIs into Indian equities," said Anita Gandhi, director at Arihant Capital Markets.

The benchmark Nifty 50 jumped 4.06% in April, its best month since November, aided by the stable earnings as well the return of the FPIs into domestic equities.

The recent slide in oil prices also supported sentiment in Indian equities, two analysts added.

FPIs sold equities worth 376.32 billion rupees in fiscal year 2023, marking two straight years of net sales for the first time, after record purchases of 2,740.32 billion rupees in FY2021.

Purchases and sales

After selling financial services shares worth 299.93 billion rupees in FY2023, FPIs bought 76.90 billion rupees in the sector in April.

Analysts said that easing risks of a contagion in the global financial system and strong corporate earnings from the sector boosted investors' sentiment. Automobile and capital goods sectors also witnessed FPI buying.

On the flip side, information technology saw selling pressure with foreign investors offloading 49.08 billion rupees worth of shares in April.

"The selling in IT stocks comes after weak outlook due to recession fears and banking crisis in the U.S. and slowdown in Europe," added Gandhi.

The rise in April has reversed losses in the benchmark Nifty in 2023. The Nifty 50 is up 0.83% in the year so far.