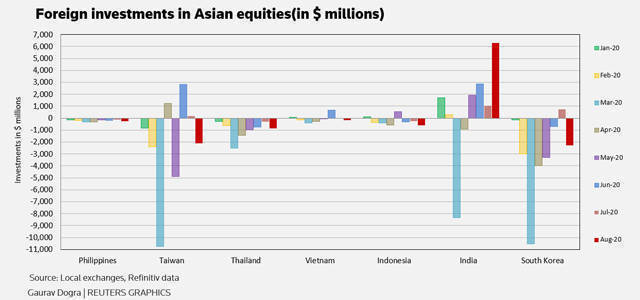

Foreigners turned net sellers of Asian shares in August as relations between China and the United States remained fragile, while Indian equities drew in foreign funds for a fourth straight month, with net inflows of $6.3 billion.

Cross-border investors sold a combined net total of $6.25 billion worth of equities in Taiwanese, South Korean, Thai, Indonesian and Philippine stocks in August, data from stock exchanges showed.

Manishi Raychaudhuri, Asia-Pacific equity strategist at BNP Paribas, put the concerns down to the latest bout of tensions between Washington and Beijing over the tech sector.

Tech-heavy South Korean and Taiwanese equities saw outflows of over $2 billion each, while Thailand and Indonesia had outflows of $875 million and $583 million, respectively.

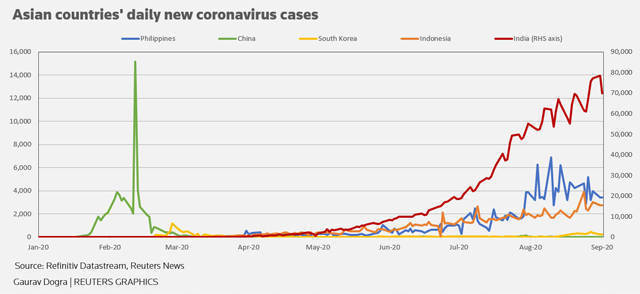

Concern over India's coronavirus outbreak has continued to grow, with officials easing restrictions on business and movement at a time when new infections are heading for 100,000 per day.

The country, however, remains one of the region's poorest economies and a cheap destination for both manufacturing and service sector outsourcing. Facebook and Google are among players to have followed Amazon in planning to pour more money into its economy this year.

After outflows earlier in the year, portfolio investment appears to be following, betting that a growing middle class in the world's single largest consumer base outside China will drive future corporate returns.

"Recent reforms like the opening of the coal and mining sector, import substitution and measures to incentivize domestic manufacturing for defense are expected to help the economy recover," said Sandip Khetan, a partner at consultancy EY.

With investors globally flush with the billions of extra funds pumped through the financial system to ease this year's dramatic downturn, BNP's Raychaudhuri said the diverse range of stocks investable in Mumbai also helped.

"Most other Asian peer markets do not offer investors such a diverse array of sectors to choose from," he said.